Binomial Option Pricing and theBlack-Scholes Formula

Although several factors have been considered in what determines an option's worth, it is intuitively obvious that what actually determines the worth of an option is the probability that the option will be in the money by expiration, and by how much. Everything else can be subsumed under these 2 variables.

If a given variable increases the option premium, it is because it increases 1 or both factors. Thus, the reason why a greater amount of time until expiration or a greater volatility increases premiums is because there is a greater chance that the option will be in the money by expiration, and by a larger amount; likewise, premiums are low for an option way out of the money, because there is little chance that the underlying asset will reach the strike price by expiration.

While prices and time intervals are easy enough to measure, what cannot be known with certainty is the volatility of the underlying asset, and therefore, the probability that an option will be in the money or by how much, before

expiration. Historical volatility is not necessarily a good indicator of future volatility, although it does provide some measure of volatility.

Various pricing models have been developed in an attempt to more accurately gauge the true worth of options, or to price them better initially, when they are first created.

The binomial option pricing model starts by evaluating what a call premium should be if the underlying asset can only be 1 of 2 prices by expiration. A variable that can only be 1 of 2 values is known as a binomial

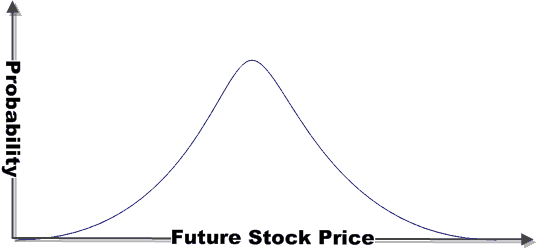

random variable. By subdividing the time into smaller time intervals with 2 possible prices that are closer together, a more accurate option premium can be calculated. As the number of time periods increases, the distribution of possible stock prices approaches a normal distribution—the familiar bell

curve.

| The probability of a stock price is proportionate to the height of the curve. |

---------------------------------------------------------------------------------

The Black-Scholes formula is the most widely used formula to calculate option premiums. Much easier to use than the binomial option pricing model, it, nonetheless, is dependent on assessing the volatility of the underlying asset, which is denoted by the standard deviation, σ, of the underlying asset prices about the current price.

Although the Black-Scholes formula calculates the premium for a call, the put premium can be calculated by using the put-call parity formula.

Note from this formula, that the standard deviation, σ, which is a measure of volatility, can be calculated if the other variables are known. This is called the implied volatility, because it is implied by the other variables. Some traders compare the implied volatility with the observed volatility to judge whether an option is fairly priced.

Now consider 2 hypothetical stocks, currently at $50 per share. Stock SSS is relatively stable, and has ranged between $40 and $60 per share over the past year, whereas stock VVV is more volatile, and has ranged from $30 to $70. Further, assume that the chance is 1/5 that either stock will be at some specific price within its historical range, listed in the table, at expiration. Obviously, a call for VVV with a strike of $50 is going to command a higher premium than the same call for stock SSS for the same expiration date, because there is a 20% chance that the VVV call premium will be worth $20 per share, and a 40% chance that it will be worth at least $10 per share, the most that the call for SSS will be worth. It is true that there is a chance that VVV will be at $30 per share, and that SSS will be no less than $40 per share, but this doesn't matter, because if the stock price is less than or equal to the strike price, then the options will expire worthless, and the chance that they will expire worthless is 50% for both stocks. Thus, if the VVV call has a chance of paying $20 per share, but the most that the SSS call will pay is $10 per share, and the chance that they will expire worthless is the same, then it makes sense that the VVV call is going command a higher premium, because it has a greater potential payoff.